This post contains affiliate links, which means I get paid a commission when you purchase through my link. Please read full disclaimer here.

Stock investing can be pretty intimidating. There is an overwhelming amount of information but not much direction. As a millennial, you know the key to financial success is to have more than one source of income, but where do you start when you have only $100 and no experience? You can buy and sell products, offer freelance services, start a dog walking business, or start a Youtube Channel. Many of these avenues have created great wealth for some people, however, it requires a lot of hard work and your ability to reach an audience before you see any results. This is why investing in the stock market is so amazing. It doesn’t require hard work or your ability to create content, and it’s suitable for anyone at any age. The overall stock market value has been appreciating since the growth and expansion of capitalism. Even with occasional crashes in the market, stock prices are always on the rise. It’s easy to see that investing in the stock market is a great way to grow your money over time.

What are Stocks?

The stock market exists in a universe of its own. It is free and dynamic allowing any investor the potential to gain limitless wealth. When you invest in a stock, you are investing in a business that has already been established and making money. You don’t need to attract customers, sell products, or put all your life savings into something that may not succeed. You can own a small piece of the world’s most successful businesses and start growing your money today.

What are Index Funds?

Index Funds are stocks that combine various companies into one package. The funds can be bought and sold from the stock market. The purpose of owning index funds is to give shareholders the ability to own multiple top-performing businesses at an affordable price. Examples of index funds are the S&P 500, TSX 60, and Dow Jones Industrial Average. Index funds act as a baseline for the general stock market’s health. There is no active management of these funds which means they have a low cost to own. They are often used as a tool for comparing the performance of individual stocks.

The advantages of index funds are they are low-risk investments and often increase in value over time with the general economy. If one stock is not performing well, the other stocks in the package will not be affected. Overall, the index fund will have minimal price fluctuation. The majority of index funds will pay out a dividend to their shareholders. A dividend is a tiny portion of the company’s earnings paid to you as a reward for investing in their company. This amount is usually shown as a percentage under “Dividend Yield” in the stock summary.

What are Bonds?

The creation of Bonds (aka Fixed Income) was a strategy for governments and corporations to raise money for their daily operations. Think crowdfunding. When you purchase a bond, there is a guaranteed return of your money with additional interest paid to you. Similar to stocks, bonds are also traded in the stock market in the form of index funds. Bonds are safe because their value in the market do not fluctuate as much as stocks do. You will see during an economic downturn, bonds will usually appreciate while stocks fall, and vice versa. A well-rounded investment portfolio includes both stocks and bonds to help protect your money during economic changes.

Beginner’s Investment Strategy

The best way to dip your toes into the stock market is to invest in a preset portfolio. Brokerage companies and recommendations from popular personal finance blogs like the CanadianCouchPotato.com, have simplified the strategies into 4 basic models. These portfolios contain stocks from Canada, United States, and International companies to diversify your investments. The bonds are all localized to Canadian government and corporations.

- Aggressive – 99% Stocks

- Growth – 70-90% Stocks, 10-30% Bonds

- Balance – 50-60% stocks, 40-50% Bonds

- Conservative – 60-80% Bonds, 40-20% Stocks

The more aggressive the portfolio, the more money you can potentially earn, but also more money you can potentially lose. The more conservative the portfolio, the more bonds it will contain. The growth will be slow, but the chances of losing money are also low. The general rule of thumb is to start aggressively and transition to a more conservative portfolio as you get older.

Choose a Broker to use your strategy

Below are the top 4 methods recommended for new investors who are just starting in their investing journey. The MER value is the “Management Expense Ratio” which is a fee paid annually by investors for the management, taxes, and operational expenses involved in running the index fund. The MER will be deducted from your account automatically. The key is to choose portfolios with MERs that are less than 0.5% to maximize your profits.

Each broker allows its users to invest in either RRSP, TFSA, or non-registered accounts. If you’re not sure which one to choose, check out my blog post on the 4 Bank Accounts You Must Have To Succeed In Adulting for more details.

1. WealthSimple – Wealthsimple Invest Account

The Easiest Option: MER: 0.4-0.5% (no management required)

WealthSimple is a Canadian platform created specifically for those who recognize the importance of investing but are not interested in managing their investments. It is by far the most user-friendly and one of the most popular investment platforms amongst millennials. During registration, WealthSimple will ask a list of questions to help assess your level of risk tolerance. Based on your answers and risk tolerance level, a custom portfolio will be assembled to meet your needs. You can also return to your portfolio settings at any time to adjust your risk level. Once you’ve decided on your portfolio, you will then set your investments to autopilot by linking your bank account to WealthSimple. Set an amount of cash to be transferred every month and watch your investments grow. Overall, Wealthsimple Invest is a set it and forget it platform which is great for all investors.

- No minimum balance required.

- Click here to sign up and get $10,000 managed for free for one year.

2. Questrade: Questwealth Portfolios

Most affordable fees: MER: 0.20-0.35% (no management required)

Questrade is a well established Canadian brokerage with the most affordable rates. Their Questwealth Portfolios includes four portfolio options ranging from Aggressive to Conservative. Once you’ve chosen a portfolio, make sure to set up automatic cash transfer from your bank account every month to top-up your investments. This is yet another set it and forget it platform, where the simplicity of auto-investing is the key to helping your money grow.

While there is a minimum balance requirement of $1000 to get started, their platform is secure and customer service is top-notch. In the long-term, the savings in the MER fees will be well worth the initial startup balance.

- No minimum balance required.

- Click here to open a Questwealth Portfolio or use the promo code for one month free MER: 526724313438297

3. Vanguard ETF Portfolios

For those who want to be more involved: MER: 0.25-0.29% (some management required)

Vanguard offers index portfolios in the form of Exchange Traded Funds (ETFs). ETFs are similar to index funds where a group of stocks are placed into one package and traded on the stock market with no active management. The Vanguard Portfolio ETFs are great for those who already have a brokerage account and would like to invest in the strategy listed above. Instead of purchasing a whole portfolio from a broker, you are responsible for purchasing ETFs from the stock market every month to top-up your investments. Vanguard has created 6 ETF portfolios with various levels of risk ranging from Aggressive to Conservative, and a new option called Retirement Income ETF Portfolio. Each ETF Portfolio has a stock ticker for you to purchase on the stock market, click on the link below for more details on Vanguard ETF Portfolios.

Once you’ve chosen the ticker with the portfolio you like, you can start purchasing that ETF through your stock broker. Be mindful of your brokerage’s commission fee for buying and selling as the fees will add up very quickly. If you would like to open a brokerage account for this strategy, check out the link below for Questrade’s affordable self-directed trading account.

- Click here to see Vanguard’s ETF Portfolios for Canadians.

- Click here to see Vanguard’s All-in-One LifeStrategy Funds for Americans.

- Click here to open a Questrade trading account today and receive up to $250 in cash reward to buy your Vanguard ETFs.

- Click here to open a WealthSimple Trade account to buy Vanguard ETFs commission free.

4. The Dividend Income Investing Strategy

(Self management required)

This YouTuber has the perfect strategy for retiring early. This strategy requires you to open a brokerage account to buy high paying dividend stocks which requires a little more effort on your part, but can provide excellent source of income for the long-term. Check out his YouTube channel: Passive Income Investing and his portfolio holdings at: Free Tools & Resources. Some of the funds’ expense ratio may be a little higher than 0.5% but the returns are exponentially greater. Keep in mind, this strategy will not outperform the U.S. stock market but instead produce a monthly income for your life expenses.

- Click here to open a Questrade trading account today and receive up to $250 in cash reward to buy high dividend stocks.

- Click here to open a WealthSimple Trade account and get commission-free trading to buy high dividend stocks.

**Remember: These brokers do not have physical branches. Customer service can always be reached through their website, live chat or phone call.

Step-by-Step Guide

- Choose one of the 4 strategies above. WealthSimple and Questwealth Portfolios are the easiest to set up. Buying Vanguard ETFs or dividend paying stocks requires a little bit more navigation as well as commission fees depending on your broker.

- Automatically transfer 15% of your income on the 30th of each month to your investing account. Most brokerages will allow you to link your bank account to the broker for automatic transfers. If you’re not sure how, call customer service. If you’re managing you’re managing your ETFs go to step 3. If not, go to step 4.

- If you choose to buy your own Vanguard ETFs or dividend paying stocks make sure to login to your account every month and purchase the quantity equivalent to the amount you transferred (including commissions).

- When dividends are paid out and deposited into your account, use that cash to reinvest back into your portfolio. Maximize the growth of your money. Some brokers have a “DRIP” (dividend reinvestment plan) system to automatically reinvest for you.

- And that’s it. Enjoy watching your account grow year-over-year. The more you invest, the earlier you can retire. Once you’re ready to actually retire, you can start withdrawing once a year to cover your annual expenses. If you just withdraw only the interest earned per year while not touching the principle, you have created a source of passive income for life!

Take a look at the example below:

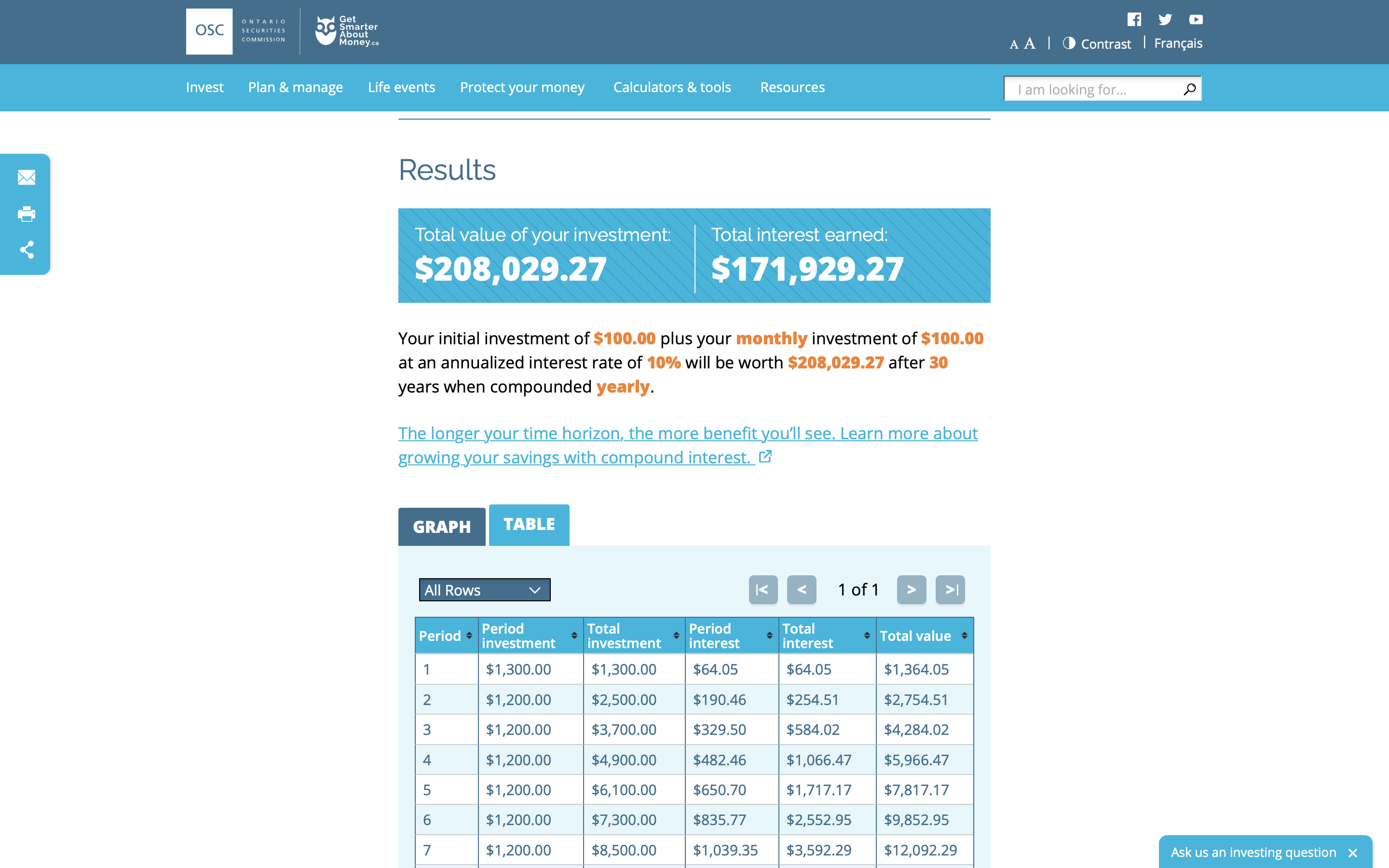

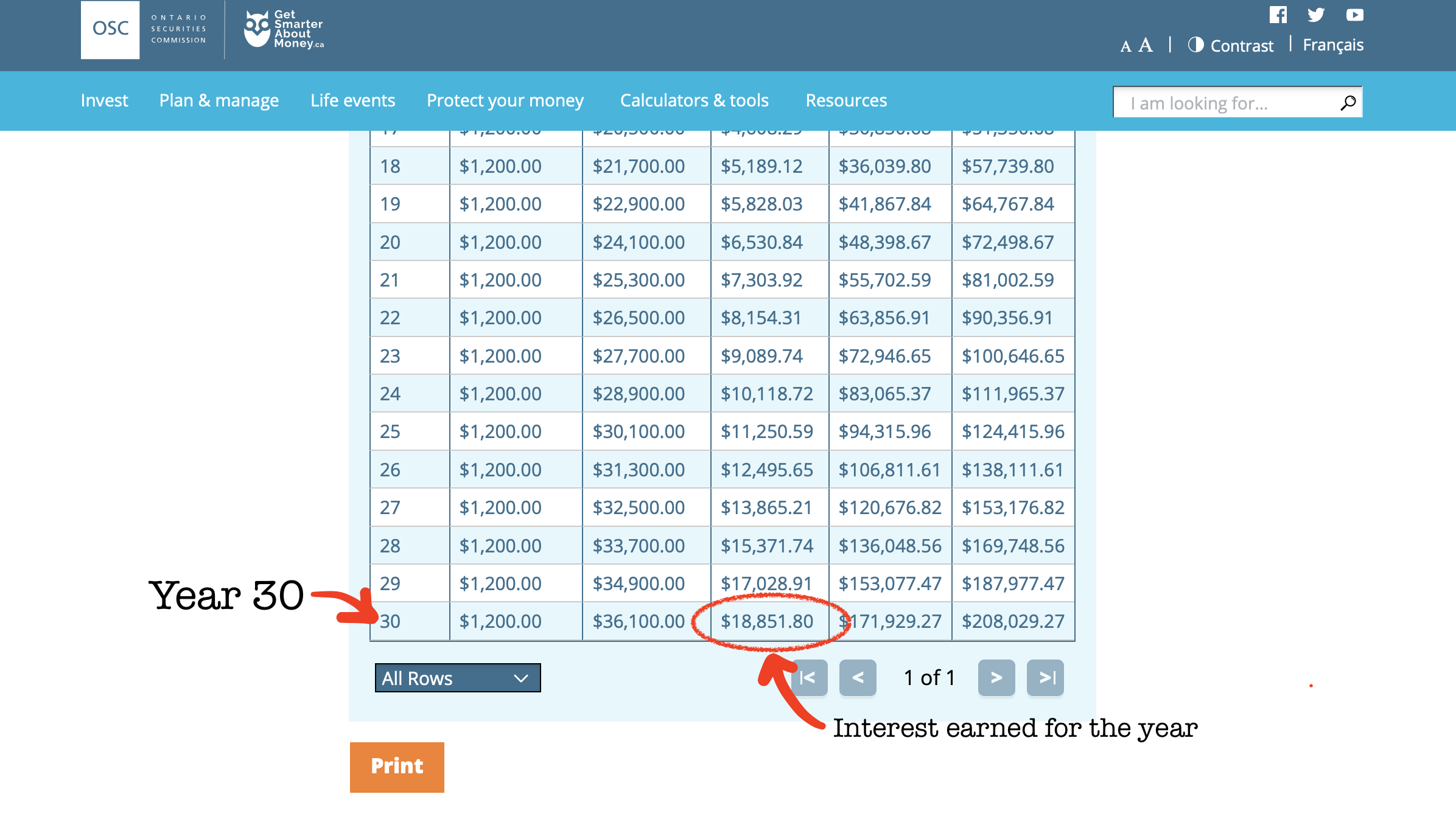

In this example, we started with $100 in the account and contributed an additional $100 per month for 30 years at a 10% rate of return annually, which is the average return for the American stock market.

In 30 years, you would have a total of $208,029.27 invested which is incredible for only contributing only $100 per month.

In the example above: In 30 years, your investments would allow you to withdraw over $18,000 a year without touching the principal balance. Don’t forget, the share price and dividends can increase over the years further growing your account.

Want to see how soon you can retire? Try out the this calculator on getsmartaboutmoney.ca

– The Wealthy Sheep

Leave a Reply