Throughout the early 2000s, personal finance shows were so addicting to watch. They showcased popular programs like ‘Til Debt Do Us Part, Smart Cookies, the Dave Ramsey Show, and so on. Seeing how the show helps strategize budget plans to organize other’s lives was liberating and super satisfying. But…how sustainable were these strategies? There’s little follow-up after the shows and there are always the odd episodes where the strategies don’t work out. Here’s why I think these budget plans are doomed to fail.

Your Personal Budget

Most budget templates will advise you to categorize your spending and savings to ensure that you live within your means. You assign your money to each of these categories where you expect to spend and you try to stick to the plan. The problem with this plan is your life is not based off of a template. Your life is ever changing and dynamic. For example, things might come up where you may need to spend more money on gas this month, or you may have a birthday next month where you could be spending more on gifts. There could also be a time where you stay home for a week because you’re feeling sick, so you spend less money on going out but more on medications and health products. Strict budgets just don’t work so let me show you what will work.

Here’s a Budget that will work

Remember your personal budget is personal. You need a budget that is as flexible as your lifestyle and helps you save for the future. The book “Worry-Free Money by Shannon Lee Simmons” was an eye-opener for budgeting strategies. Here is how you should be structuring your budget:

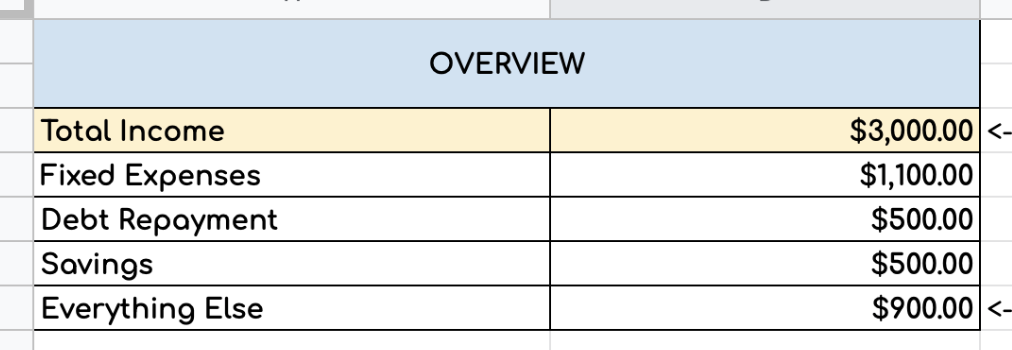

The majority of the categories here are mostly familiar but the game changer here is the “EVERYTHING ELSE” category.

What is the Everything Else Category?

The everything else category will encompass your daily lifestyle spendings. This includes food, movies, gifts, transportation, hobbies, clothing, personal care and other expenses that vary each month. Because these expenses vary so much it’s difficult assign a fixed budget to each of these items. To keep things simple, we will lump these items together and call it the Everything Else category. Feel free to spend this set amount of money however you see fit.

Here’s an example of what your budget could look like:

- Your Total income every month is: $3000

- Fixed monthly expenses including rent, insurance, Netflix, and so on: $1100

- Debt Repayment every month: $500

- Your monthly savings: $500

- That leaves you with $900 per month for your Everything Else spending. (Highly recommend you use a Debit Card or Cash to avoid over spending)

** Note: You should focus on paying off all your (non-mortgage) debt before saving for retirement.

It’s important that you keep track of all your spending to hold yourself accountable to the plan you’ve made. Use tools like google sheets, the every dollar app, or handwrite all your spendings each week to keep track of your cash.

That’s it. It’s really that simple. Regardless of which method you choose, as long as you stay consistent and follow your plan, you will be on the right path to building your wealth.

Get your free Cash Back Debit Card: Wealth Simple Cash – 1% back on all purchases.

Use my promo code: VUJHGA to receive a cash bonus.

Download the spreadsheet template here to help keep your spending on track

-The Wealthy Sheep

Good article!

Cheers