IN-THE-MONEY COVERED CALL

In our Investment Plan: Level 1, we discussed purchasing 100 shares of a stock in order to start the Covered Call strategy, however, what if you don’t own 100 shares of a stock yet and you don’t want to pay full price for it? This is where the In-the-Money Covered Call strategy comes into play. This strategy gives you the ability to purchase stocks at a discounted price.

When a Call Option contract is In-the-Money (ITM) it means the current share price is greater than the contract’s strike price. This will work in your favour when your goal is to purchase at a discount.

** This strategy can be done within TFSA and RRSP accounts for tax saving purposes.

See the steps below to on how it’s done:

In this example, we are going to use AAPL or Apple, which is currently being worth $222/share.

1. Buy 100 Shares of a Stock

Just like in Investment Plan: Level 1, you need to first purchase 100 shares of a stock to start this strategy. In this scenario we will buy 100 shares of AAPL.

100 x AAPL $222/share = $22,200

2. Sell 1 ITM Call Contract

Choose a date that’s about 30-45 days from today. Then go to the Call side of the options chain and choose a strike price that’s less than what you paid for those 100 shares of stock.

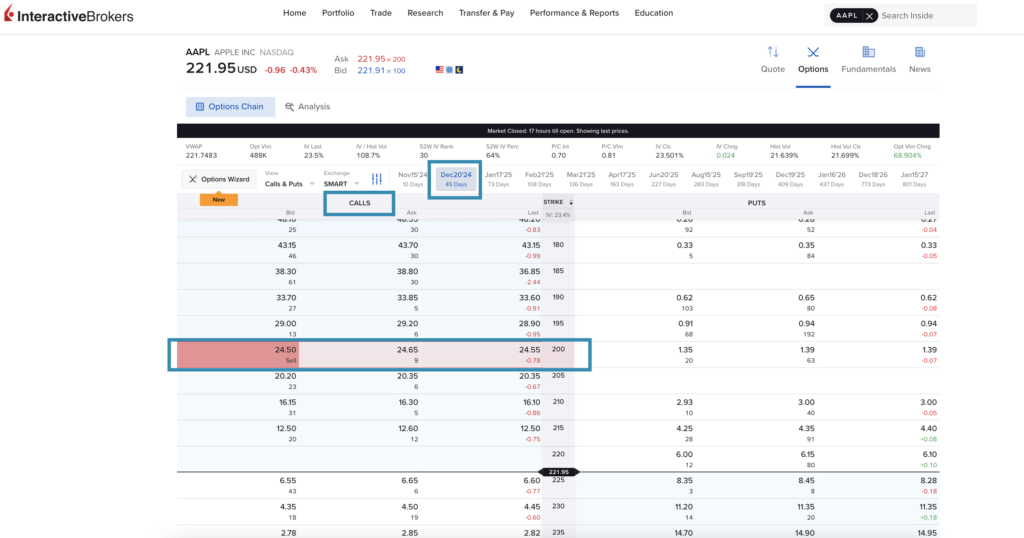

In this example, we are looking at the options chain of December 20, 2024 which is 45 days until expiration. The Call options are on the left side, all the options highlighted in light blue are the options that are considered ITM, or less than what the current stock price is. The further in ITM, the more expensive that option becomes. I like to choose strike prices ending in 0 or 5, they typically have more volume and better pricing. See below, we are going to choose the strike price $200.

Looking at the options chain above, the Call options at strike price of $200 expiring 45 days from now is valued between $24.50-24.65. To initiate this trade, click on the Bid Price to sell 1 contract for $24.50. Since you own 100 shares already, the total premium collected will be $24.50 x 100 shares = $2450.

You now own 100 shares of AAPL for less than what it’s currently worth. Here’s the math:

You purchased 100 shares for $22,200

You sold 1 call option and collected $2450

Your Actual Cost: $22,200 – $2450 = $19,750 (Which is equivalent to $197.50/share)

3. WHAT HAPPENS ON EXPIRATION DAY?

If the stock rises above…

If the stock remains above your Call Option strike price, then you must sell all 100 shares at the strike price you chose. This action is also called “exercised.” But remember, you purchased these shares for a discounted price, so you will have a net gain after the trade expires.

Here’s the math:

Apple is now trading for $222 which is well above the $200 call option strike price. You must sell your 100 shares for $200 each, but remember you purchased the stock at a discounted price of $197.50/share.

$200(option strike price) – $197.50(your actual purchase price) = $2.50 gain

Final total: $2.50 gain x 100 shares = $250

You have now earned $250 from this trade! Repeat Step 1 on the following week.

If the stock drops below…

If the stock drops below your Call Option strike price, then you keep the 100 shares of the stock and switch to selling Covered Calls. Choose a strike price that’s above your cost per share with 30-45 days until expiration. Continue this step until your shares are exercised, then Repeat Step 1 at the top of this page.

For example:

Your actual purchase price of AAPL was $197.50. So you must choose a call option strike price that’s greater than $197.50 like $200 or $210 strike. Click the link below to refresh your memory on how to sell a Covered Call.

See Investment Plan: Level 1 to review steps for Covered Calls.

HOW MUCH CAN YOU POTENTIALLY EARN FROM THIS STRATEGY?

- Selling 1 Call Option @ $2.50 = $250/mo.

- Selling 5 Call Options @ $2.50 = $1250/mo.

- Selling 10 Call Options @ $2.50 = $2500/mo.

Helpful Tips:

- Only trade this strategy 1-2 times per month to avoid getting taxed as a self-employed business

- Avoid choosing expiration dates that contain dividend payout days, your shares could be exercised earlier and you’ll lose the dividend payout.

- Avoid choosing expiration dates that contain earnings or product release events for that stock. Anything can happen, the stock could swing up or down significantly.

- Choose to trade ETFs where no single news events would have a big impact on the share price.

- This strategy works best in markets that are trending upwards or sideways.

-The Wealthy Sheep 👩🏻💻