This article contains an affiliate link at no cost to you.

Here is a strategy to help you generate $500 or more every month tax-free on a $15,000 investment. This trading plan is called the Covered Call Strategy. It is the easiest options trading strategy that you can use every single month within your tax-free accounts. The covered call strategy is often incorporated in many investment products from larger hedge funds because of its low risk nature, and its ability to generate a healthy consistent income for their clients.

If learning this strategy is too complicated for you, head over to my blog on “The Dividend Investing Strategy for Long-Term Passive Income” for an easier long-term plan.

In order for this strategy to truly become tax-free, you must execute these trades within a TFSA or an RRSP trading account (aka tax-sheltered account). This way, your gains and losses will not affect your income taxes. You can also place these trades within a cash/margins accounts if you want to trade more often, but be prepared for taxation and keep track of all your trades with an excel sheet.

Start by opening a trading account with a broker that offers Level 1 (or the covered call strategy) Options trading. Most banks will have this feature but be aware of high commission fees.

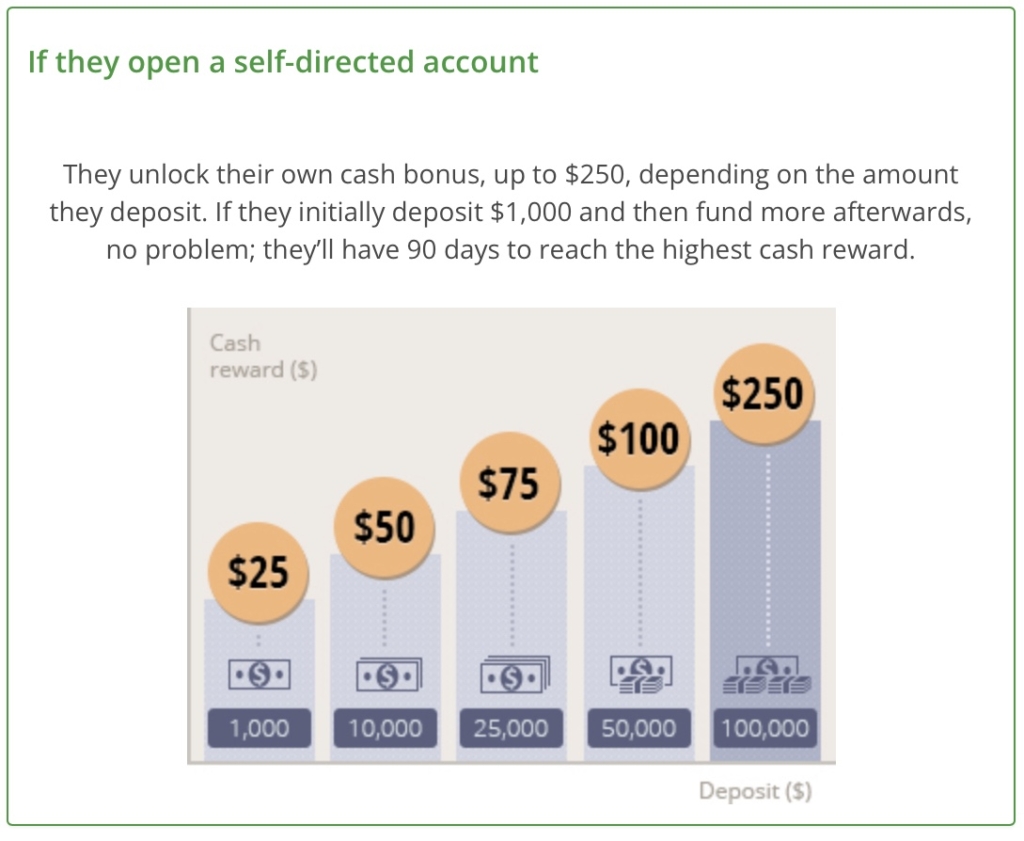

I personally use Questrade for their low fees and ease of use. Click here open a new Questrade self-directed account and add the promo code: 526724313438297. You can receive up to $250 after your first deposit, see details below.

**Remember to choose either a TFSA or RRSP trading account and enable Level 1 options trading.

If you’re nervous about starting and you’ve never traded stocks before, open a practice account to learn at your own pace, click here to sign up for a free Questrade’s Practice Account.

Step-by-Step: The Covered Call Strategy

#1: Choose a stock

- Look through the S&P 500 index fund and check out all of its holdings (click here).

- Choose a stock within the S&P 500 that’s priced over $100 per share.

- Ensure the stock displays a consistant upwards trend over the last 5-10 years. In this example, I’m going to use AMD.

- Check to see if this stock contains options contracts. If not, move on to the next stock.

Here’s how it’s done:

#2: Buy 100 shares of the stock

Now that we’ve chosen a stock, we are now going to buy 100 shares of this stock.

At this time, AMD is trading at $112/share which means we will need $11,200 to own 100 shares:

$112 AMD x 100 shares = $11,200

- Calculate the amount of money you’ll need to buy 100 shares of your stock. Transfer a little bit more than you need to your trading account to cover commission fees.

- Buy 100 shares of your stock. It’s best to buy stocks on a day when the overall stock market is red and your stock is at a discounted price.

- Create a “Limit” order with GTC (Good till cancel) to buy the shares at a price you feel is reasonable. The order will stay active for 90 days or until you cancel. If you want the order to fill right away, choose “Market Order.”

Here’s how it’s done:

#3: Sell 1 Call Option. This is where you collect cash.

- Go to the options chain and click on Call Options.

- Choose an expiration date that’s 30-45 days out.

- Choose a price in which you are willing to sell your stock, this is known as the strike price. Make sure the strike price is higher than what you purchased the stock for. Look for strike prices that end in “0” or “5” as they tend to have more volume making it easier to trade.

- Click on that strike price and hit SELL. Again, use a limit order to set your price or market order if you want your orders to be filled right away.

- Great, you’ve just collected cash! Now you have created a “rain check” to sell your shares at a set price.

See how I instantly received $665 in the video below:

What happens on expiration day?

On expiration day, either of the two scenarios can happen:

If your stock value rises above the strike price on expiration day

You will have to sell all 100 shares of your stock at the strike price. This is known as “getting called away.” This action is executed automatically by your broker. After you sell your shares, you can repeat the above steps to initiate another covered call on the same stock or another stock.

For example:

AMD is now valued at $120/share on March 25, 2022, and I sold a covered call at the strike price of $115. I will have to sell my 100 shares for $115 each, but I get to keep all the premium collected plus the profits for selling the stocks.

Share price: $115(sell price) – $112(buy price) = $3 x 100 shares = $300

Covered Call: $665 collected from selling the call option.

Total profits: $300 + $665 = $965

If your stock stays below the strike price on expiration day

Then you keep all the premium collected and sell another call option on the following Monday.

For example: AMD is now valued at $114 on March 25, 2022. Nothing happens to my AMD shares and I will sell another call option 30-45 days out.

Total Profits: $665 collected from selling the call option

Can I make more than $500?

Yes you can! A covered call trade requires you to own shares in multiples of 100s, so if you have more money you can buy more of the same stock. You can also buy more expensive stocks that produce a higher option premium.

100 Shares of AMD = $665/month

500 Shares of AMD = $3,325/month

1000 Shares of AMD = $6,650/month

Pro Tips:

- If your stock pays dividends, do not sell options that expire during the week of dividend payouts. Your shares get called away early before you collect those dividends.

- Avoid selling options during week of earnings. The stock’s Earnings Announcement or major events can cause price fluctuation. Hold off from selling until the after the news announcements.

- There are no account minimums required. You can start building your wealth earlier and faster.

- You can buy, sell, and withdraw cash from your TFSA without taxation. A powerful tool to help Canadians earn extra income.

- Within your TFSA, all U.S. stocks that pay a dividend will be subject to a 15% withholding tax. This is taxed automatically and deducted from your account. You cannot claim these deductions on your income tax.

The Downside

- Your shares can decrease in value and never recover, that’s why it’s so important to choose high quality stocks. If this happens, you can either hold on to the stock and continue selling covered calls, or sell the stock at a loss and move on.

- There are limits to how much money you can deposit into tax-sheltered accounts. As of 2022:

- TFSA has a cumulative total of $81,500

- RRSPs have an annual total of 18% of your income and up to the max of $29,210

- You cannot claim any losses on your income taxe if you trade in tax-sheltered accounts.

- Your portfolio losses will not increase your contribution room for the tax-sheltered accounts.

- You may be taxed if you trade too frequently within these accounts. Limit your trades to just once or twice a month. If you would like to trade more often, use a cash or margins account.

Can you sell covered calls on cheaper stocks?

Yes! The premiums you collect will be much smaller but it’s still a viable strategy for smaller accounts.

Can you quit your job ?

Absolutely! If you can prove to yourself that you can make a consistent income with covered calls, you can quit your job to pursue your passions.

Happy Trading.

– The Wealthy Sheep

Leave a Reply