Dividends Investing is one of my favourite strategies for establishing a stream of long-term passive income. It is currently the main strategy I use for my retirement account which has grown to over $30,000 over the past 3 years. The reason why this strategy works so well is because it doesn’t require active management, so the risk of unnecessary trading is greatly reduced.

Here’s the quick version of this strategy: Set up your bank account to automatically transfer 15% of your take home pay each pay day into a brokerage account. Purchase stocks that pay high dividend yields. The more shares you buy, the more dividends you will receive. Pretty simple.

What are dividends?

Dividends are portions of the company’s earnings paid to you as an incentive for investing in their company. This amount is usually shown as a percentage under “Dividend Yield” in the summary page. The dividends are paid out either monthly, quarterly, annually, or bi-annually. Keep in mind, dividends can be reduced or discontinued at any time, especially when the company’s performance is poor.

Which stocks should I buy that pay dividends?

For those who don’t enjoy doing research or making decisions on which stocks to buy, please check out my blog post Stock Investing Strategy for Beginners with Less Than $100 for simpler investing strategies.

If you prefer to choose your own stocks, then use the following criteria below:

- What is the overall trend of this stock? You want to see an overall uptrend which indicates the company is growing year-over-year. If the company is in a downtrend then they are more likely reduce their dividends payouts.

- How long has this company been around? The longer the company has been in business the more assurance you’ll have in the company’s ability to continue paying dividends for the long-term. Companies like IBM, Coca-Cola and Bank of Montreal have been around for over 100 years.

- Does this stock offer dividends? If so, how much? Use dividendhistory.org to see if how much and how often dividends are paid out from your stock. You want to make sure there are no or very few missed payments.

- Is it too good to be true? When you see dividend yields that are over 10%, make sure you are not buying from young and inexperienced companies.

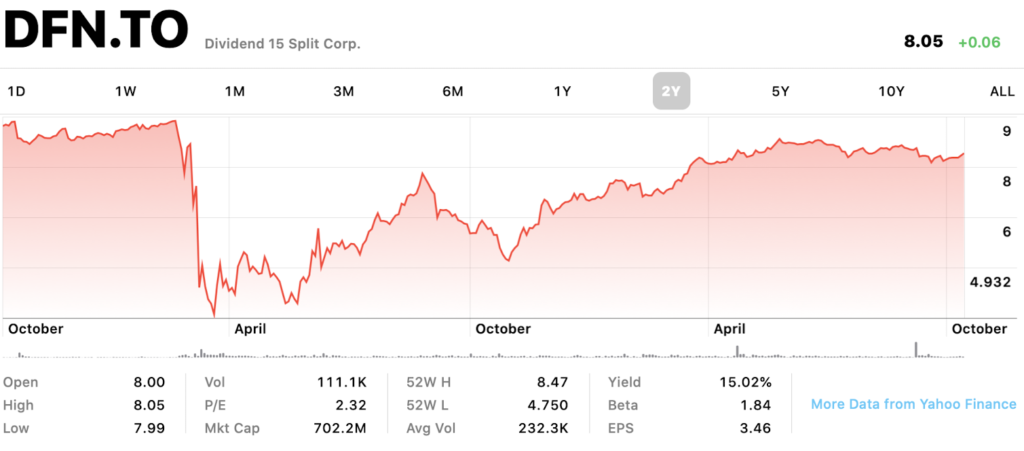

Take a look at this example below with Quadravest’s Dividend 15 Split Corp.

How much money do you need to retire?

This will depend on what your yearly expenses looks like. It’s super important to create a budget to evaluate how much money you’ll need to support your lifestyle. Let’s say, for example, you’ve determined $50,000/year is what you’ll need to cover your daily expenses. Using our above example of DFT.TO you will need:

- Dividend payment: $8.05 x 15.02% = $1.21/year

- Shares you need: $50,000 / $1.21 = 41,323 shares

- Money required: 41,323 shares x $8.05 = $332,644.63

The math here shows that you will need $332,644.63 to purchase 41,323 shares of DFT.TO to produce $50,000 a year in dividends. In other words, you don’t need to be a million dollars to retire on your terms. You just need an effective strategy to fund your retirement.

What’s great about this strategy is you’re able use it within your tax-deferred accounts, so you do not need to pay taxes on the dividends or from buying or selling the stock. Just make sure to keep your US stocks within you RRSP account to avoid taxation.

When choosing stocks make sure you do your own research and diversify your portfolio. Remember, you never want to own too many of the same stock.

Here’s where you can find high paying dividend stocks

Recently a friend shared with me an impressive Youtube channel called “Passive Income Investing“ where this young couple retired in their 30s by purchasing high paying dividend stocks. Their portfolios are a complete game changer and their information is all free so make sure to check out their Youtube channel and their website here on Passive Income Investing.

Dividend Investing Summary

- Create a brokerage account for buying and selling stocks. Preferably an RRSP or TFSA. If you’ve maxed out on both of these accounts then open a cash trading account. US listed stocks will not be taxed if you trade them within an RRSP. I highly recommend using WealthSimple Trade or Questrade.

- Aim to invest at least 15% of your take home pay. The more you can invest, the earlier you can retire.

- Make a list of 10-20 stocks and ETFs you would like to purchase that pay dividends. Check out Passive Income Investing for inspirations.

- Repeat step 2 and watch your account grow!

- Once your portfolio generates enough money cover your daily expenses, you have reached the milestone of early retirement.

- Withdraw cash monthly to cover your expenses, and only take out what you need for the month. The rest of your money will continue to grow as you reinvest the dividends back into the stock market.

Dividend Payout Tracker

Keep track of all your dividend paying stock purchases with this free google sheets template. Dividend payouts are calculated annually.

Click here to download a copy of the Dividend Payout Tracker.

-The Wealthy Sheep

Leave a Reply