The main strategy I use for day trading is the 15min Opening Range Breakout (ORB). I learned this strategy from a youtube channel called “Axe Options” which focuses on trading options however this can also be applied when trading futures. Every morning I wait for the market open at 0930am Monday to Friday. I watch the charts during market open without entering a trade. Using the 15min interval chart I can analyze and interpret the movements before executing my plan (Times are in EST zone).

15min ORB Strategy: When the clock hits 0945am:

- Draw a horizontal line to mark the highest point of the 15min candle.

- Draw another horizontal line to mark the lowest point of the same 15min candle.

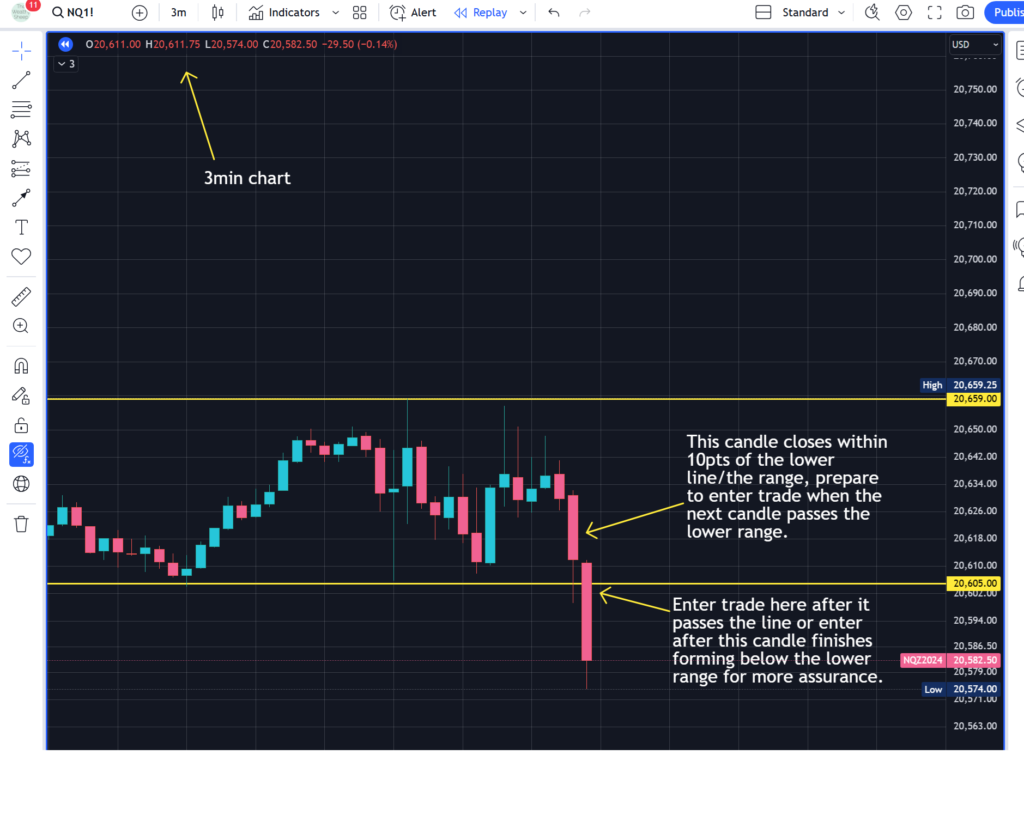

- Switch to the 3min chart and wait for the price to close outside of the boundary lines of the high or low of the first 15min candle.

- If a 3min candle closes above the highest 15min ORB line, then enter a Long position. If a 3min candle closes below the lowest 15min ORB line, then enter a Short position.

- Once the position becomes profitable, move the stop loss to protect profits.

- Take no more than 2-3 trades per day.

**Preset Stop Loss:

For NQ = $250/12.5pts

For MNQ = $30/15pts

Using the NQ chart, see how to mark the high and the low of the first 15min candle

Marking the Opening Range Breakout (ORB)

Now switch to 3min chart and wait for a candle to close outside of the high or low level to enter 👇

**Note: I will sometimes switch to a 5min chart if the market is choppy. The higher the timeframe the more accurate the price action reading. (I will keep the 15min chart open on another monitor to keep track of the overall market movement)

Candle break to the downside of the ORB, sell to enter trade

Or see below for alternative entry strategy 👇

Move stop loss to protect your profits 📈

You will take profit and be stopped out of your trade once the price hits your stop loss or your take profit order. In the above scenario, that would mean a $500 profit💰.

This strategy has an 80% win rate when using it to trade the indices like NASDAQ and S&P500. This means there will inevitably be losers, however if you stick to the plan and keep your losses small, you will still be profitable in the end. Below are additional rules that I incorporate into to improve the overall accuracy of my trades.

Other rules that I incorporate into my trades:

- Include the Pivot Point indicator can be used as support/resistance levels

- Don’t let a winner become a loser, move your stop loss 5pts at a time to lock in your gains

- Do not FOMO into a trade

- Do not trade during FOMC announcement days

- Always check the economic calendar to make sure you’re not trading at the time of announcements

- If the day is choppy or candles are not moving up or down, it’s helpful to look at longer timeframes like 5min and 15min chart before entering the trade. You can also choose to avoid trading that day altogether.

- The movement of ES should match NQ, if not, don’t enter trade

Happy Trading 👩🏻💻

-The Wealthy Sheep

Leave a Reply